17+ Amortization rate

Calculate loan payment payoff time balloon interest rate even negative amortizations. The regular credit the alternative simplified credit the energy research credit and the basic or university research credit.

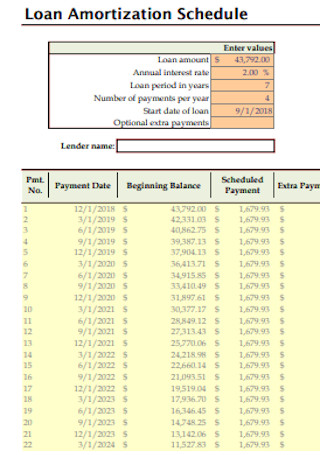

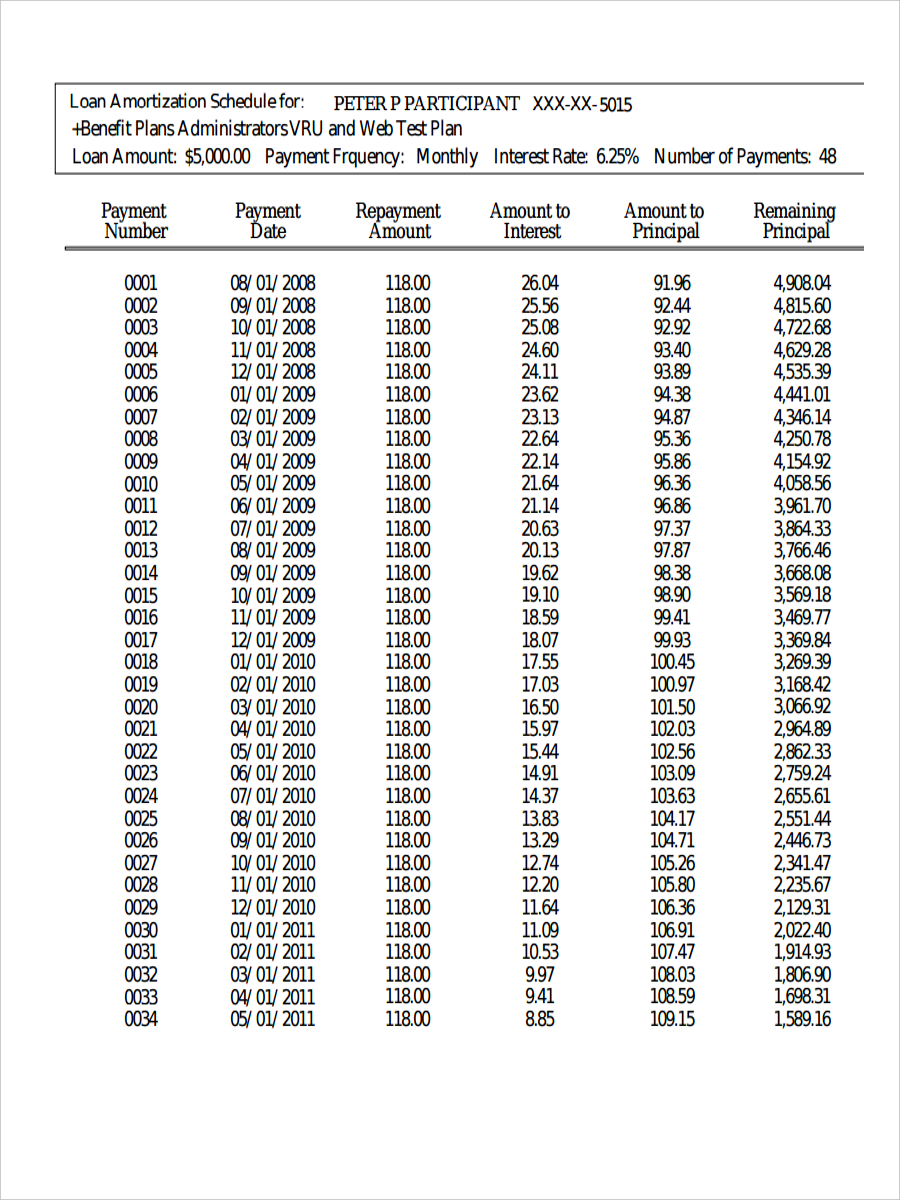

8 Sample Loan Amortization Schedules In Pdf Ms Word

7YR Adjustable Rate Mortgage Calculator.

. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then. The term of the loan is 360 months 30 years. This is normally seen on a loan amortization schedule on excel.

Almost any data field on this form may be calculated. A better rating meant a greater likelihood for repayment which in turn meant less risk for the lender. It also refers to the spreading out.

Your interest rate 6 is the annual rate on the loan. Amortization Formula in Excel With Excel Template Now let us see how amortization can be calculated by excel. TALK TO OUR HUMAN.

Under a 25 percent tax rate economic output would be 04 percent lower and the capital stock would be 11 percent smaller. The credit was classified as a Section 38 general business credit subjecting it to a yearly cap while lowering the credits statutory rate to 20 percent. Since amortization is a monthly calculation in this example the term is stated in months not years.

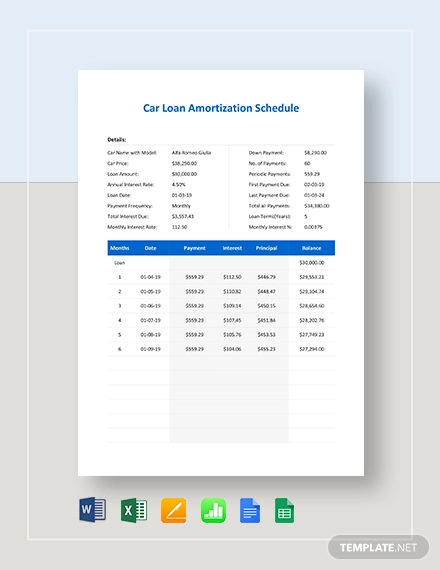

Whether you are buying an used car or finance for a new car you will find this auto loan calculator come in handy. Mortgage has developed the first ever reverse mortgage amortization calculator that lets you change future interest rate appreciation rates and payment assumptions. Suppose for example a business issued 10 2-year bonds payable with a par value of 250000 and semi-annual payments in return for cash of 241337 representing a market rate of 12.

An increase in the corporate income tax rate to 28 percent would reduce economic output by 08 percent in the long run while reducing the capital stock by 21 percent. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Self-Employed Home Loan Income Express.

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. If this looks funny click the small spreadsheet-looking icon at the bottom-right corner of the final cell and select Copy Cells. Calculate the percent change from one period to another using the following formula.

This calculator will compute a loans payment amount at various payment intervals -- based on the principal amount borrowed the length of the loan and the annual interest rate. 1 2 It will replace IFRS 4 on accounting for insurance contracts and has an effective date of 1 January 2023. The lender charges interest as the cost to the borrower of well borrowing the money.

Mortgage options and process mortgage basics. If you need to create an amortization schedule with an. It simply includes the fees rate of interest and taxes payable in the loan.

Here is an example amortization schedule for a loan with the following characteristics. Now if we took the same example from above but stretched out your repayment plan to a 30-year mortgage your interest rate would probably bump up to 4 and your monthly payment would drop to 1146. Now we have to calculate EMI amount for the same.

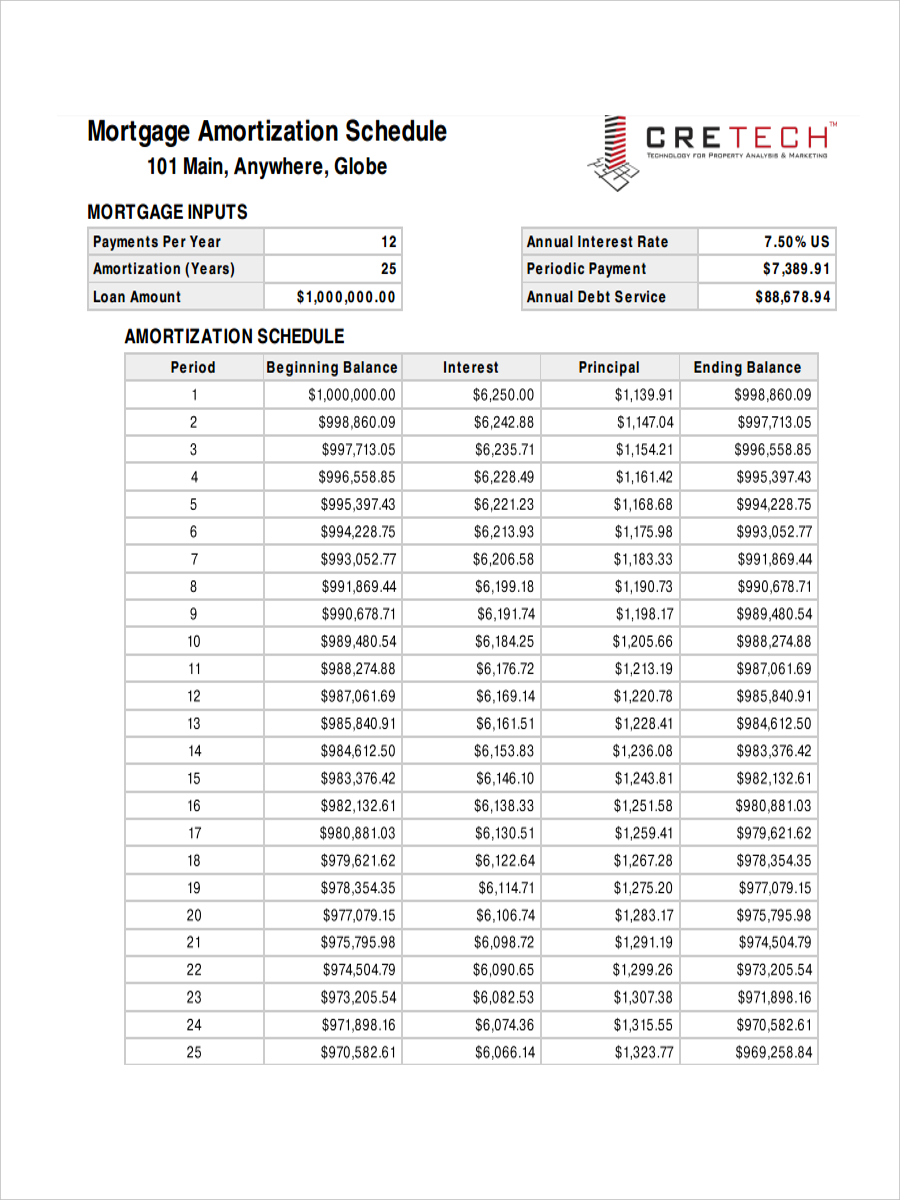

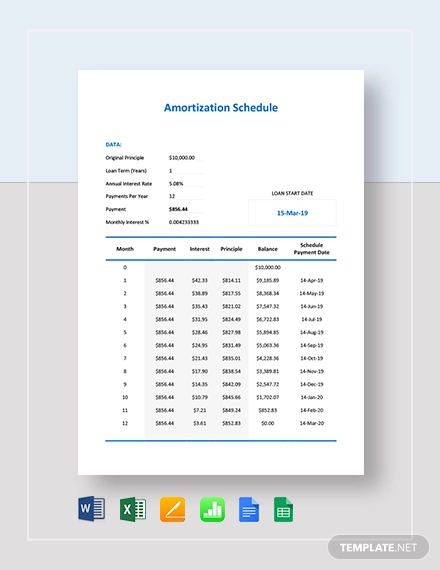

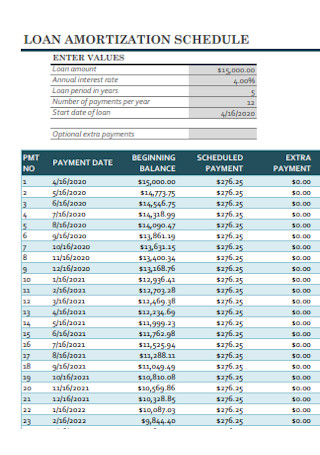

An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan. 30-Year Mortgage Amortization Schedule by Month. Bonds Payable Issued at a Discount.

By Jeff Keleher on 1172022 Tags. An identical process is followed if the bonds are issued at a discount as the following example shows. The loan will begin on March 1 and the entire 4 million of principal will be due five years later.

Amortization Schedule is an amortization calculator used to calculate mortgage or loan payments and generates a printable amortization schedule with fixed monthly payment. The formula is shown. Amortization in excel is Calculated Using Below formula.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. The RD tax credit now has four separate elements.

Percent Change 100 Present or Future Value Past or Present Value Past or Present Value. Once created amortization schedules hold true until one or more of the variables used to create them changes. IT is the amount of dollar total of all interest payment on the loan.

Car loan calculator with amortization schedule and extra payments to calculate the monthly payment and generates a car loan amortization schedule excel. Home loans with negative amortization. Download our FREE Reverse Mortgage Amortization Calculator and edit future.

How Does a Cash-Out Refinance in Texas Help Homeowners. To calculate amortization you will convert the annual interest rate into a monthly rate. If your interest rate is 5.

Americas 1 Rated Reverse Lender Celebrating 17 Years of Excellence. Home Mortgage Companies in TX March 17 2022. Monthly Bi-weekly Trade In Value.

Then once you have computed the payment click on the Create Amortization Schedule button to create a chart you can print out. Your monthly interest rate Lenders provide you an annual rate so youll need to divide that figure by 12 the number of months in a year to get the monthly rate. If anything the above tables understate the current dominance of the 30 year FRM.

Lenders would then rate loan applicants on their perceived ability to repay the full loan amount. Your monthly payment is 59955. IFRS 17 is an International Financial Reporting Standard that was issued by the International Accounting Standards Board in May 2017.

You simply take the interest rate per period and multiply it by the value of the loan outstanding. Brets mortgageloan amortization schedule calculator. A couple took an auto loan from a bank of 10000 at the rate of interest of 10 for the period of 2 years.

This is a result of the time value of money principle since money today is worth more than money tomorrow. You can also use the button at the bottom of the calculator to print out a printable loan amortization table. Assume that a company incurs loan costs of 120000 during February in order to obtain a 4 million loan at an annual interest rate of 9.

Interest is easy to calculate. Asking about the APR rate simply will help you in knowing the cost of the loan. This populates all the cells through row 367 with the amortization schedule.

8 Sample Loan Amortization Schedules In Pdf Ms Word

How Do Intangible Assets Show On A Balance Sheet

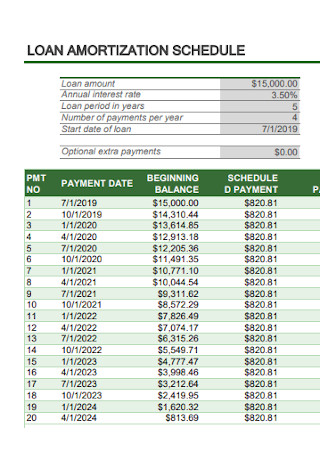

Tables To Calculate Loan Amortization Schedule Free Business Templates

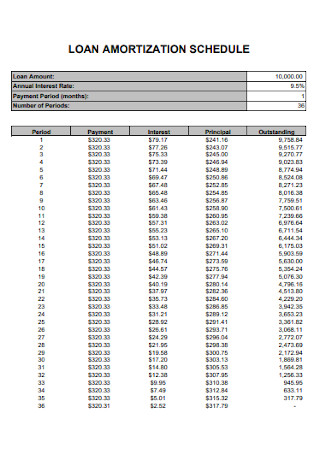

Amortization Schedule 10 Examples Format Sample Examples

8 Sample Loan Amortization Schedules In Pdf Ms Word

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Amortization Schedule 10 Examples Format Sample Examples

Amortization Schedule Example Amortization Calculator Things Prepared Before Buying A Home Preparationof Homebuying Amortization Calculator Amortization Schedule Mortgage Amortization Mortgage Amortization Calculator

Amortization Schedule 10 Examples Format Sample Examples

8 Sample Loan Amortization Schedules In Pdf Ms Word

Tables To Calculate Loan Amortization Schedule Free Business Templates

Amortization Schedule 10 Examples Format Sample Examples

Amortization Schedule 10 Examples Format Sample Examples

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates